Find out how much it costs to maintain a house in Portugal. From property taxes, to utiliy costs, property management services and holiday home rentals...

When the time comes to buy a house abroad many families wonder about the general cost of maintaining their property. Regardless of whether you choose to live here permanently or to have a second home or real estate investment for holiday rentals, every smart buyer wants to save money.

This question is particularly relevant when clients are unfamiliar with Portuguese laws or wary of utility costs such as electricity.

Here are some basic facts that will help you understand more about the cost of maintaining real estate property in Portugal. Also, see what options are out there to help you save money while enjoying all this beautiful country has to offer:

Real Estate Taxes

Owners of real estate or land in Portugal have to pay Municipal Property Tax, known as IMI (Imposto Municipal sobre Imóveis). The rate of this tax depends on the property’s location, size and characteristics.

Who has to pay?

According to the IMI rules, anyone who owns a property or land on the 31st of December of each year has to pay IMI tax the following year.

Exemptions:

- Families with a gross annual income under €15,295 or with properties evaluated under €66,500 are exempt from paying IMI.

- Permanent homeowners may be exempt from IMI for three years if the property value is equal to or less than €125,000 and the annual taxable income of the family under €153,300.

- Other exemptions include political parties, non-profit organizations, etc.

How is IMI calculated?

The IMI calculation formula is very simple, you only have to multiply the rate by the VPT - Valor Patrimonial Tributário (Taxable Asset Value):

IMI tax = rate x VPT

The rate is set annually by the municipality where the property is located. In urban buildings, the rates vary between 0.3% and 0.45%. In exceptional cases, the fee may go up to 0.5% (old maximum rate). In rustic buildings, the rate is 0.8%.

The VPT is determined by the AT - Autoridade Tributária e Aduaneira (Portuguese Tax and Customs Authority) and is based on factors such as the age of the property or construction price per square metre.

How to pay?

IMI can be paid in installments, depending on the amount. If the amount is less than €250, payment is made in one installment in April. If the amount is between €250 and €500, the payment is divided into two installments, in April and November.

Utility Bills

Utility costs also depend on the size of the property, materials used in the construction, the number of people living in it and day to day general use. For example, a new build with an energy certification of B or higher will have much lower comfort costs. Another way of reducing costs is to install renewable systems such as solar panels that guarantee higher energy efficiency.

To get an idea of the costs in general, here is a monthly estimate of costs:

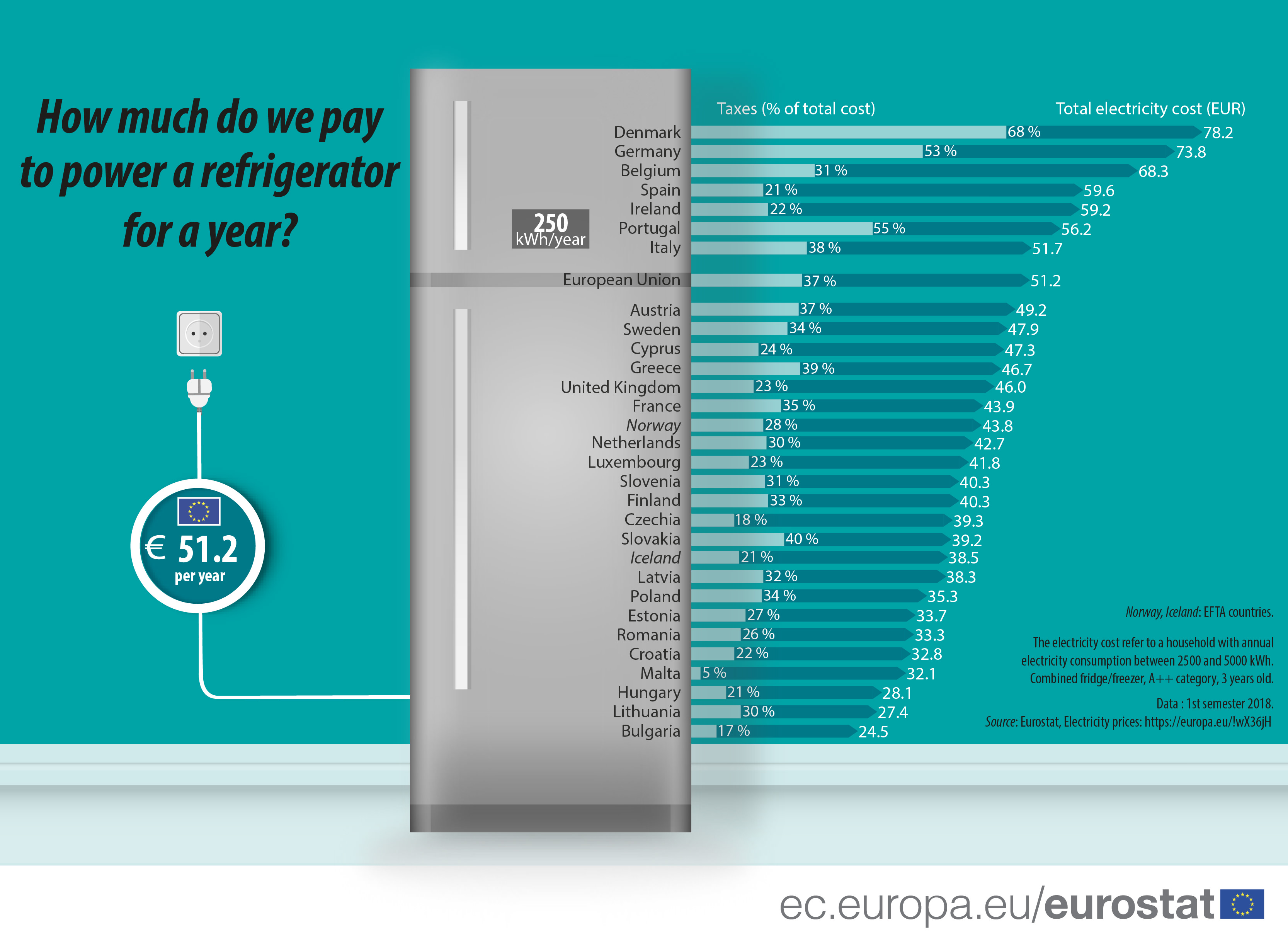

Electricity prices in Portugal are actually lower than other European countries such as Denmark, Germany, Belgium, Spain and Ireland (Eurostat, 2018):

Property Management & Rental Services

If your property is a second home or you intend to maximize your investment through holiday rentals, rest assured you don't have to take care of everything yourself. Companies such as Silver Coast Hospitality offer years of experience in property management and home rentals, with a professional service aimed at your comfort and peace of mind.

With regard to holiday home rentals, they practice a minimum commission of 15% that includes managing touristic rental licensing ("Alojamento Local", mandatory by Portuguese law) and promoting your property actively to maximize rental yields.

As for property management, you can opt for a simple key holding to a more complete service that includes everything from collecting the mail to cleaning, laundry, garden & pool maintenance.

If you'd like to know more about living in Portugal and investing in Portuguese property don’t hesitate to contact us! We have a large selection of property for sale in the Silver Coast and work directly with a strong network of partners that will assist you in making your experience of buying property in Portugal simple and hassle-free.

Portugal Realty™ - Property for sale in Portugal